WHO SHOULD READ THIS

- Any principal, contractor or subcontractor engaged in the Queensland construction industry.

WHAT YOU NEED TO KNOW

- A large number of changes have been proposed for the Queensland construction industry. While the Bill is yet to be passed by Parliament, it is likely that the Bill will be passed in substantially the same form.

WHAT YOU NEED TO DO

- Head contractors should become familiar with the amendments to the project bank accounts regime, and should also be aware of the introduction of a ‘supporting statement’ for payment claims.

- More broadly, participants in the Queensland construction industry should note the changes, particularly the additional options to enforce an adjudication decision and the introduction of new offences for executive officers.

Continuing on the path of reform that began following the commencement of the Building Industry Fairness (Security of Payment) Act 2017 (Qld) (BIF Act), the Queensland Government has proposed extensive amendments to the BIF Act, and to other legislation governing the construction industry in Queensland. The proposed changes are contained in the Building Industry Fairness (Security of Payment) and Other Legislation Amendment Bill 2020 (Qld) (Bill), tabled before Parliament on 5 February 2020.

Key changes

The Bill proposes a large number of changes, including to project bank accounts, security of payment, licencing, building certification and the oversight of architects and registered professional engineers.

Key changes include:

- Project bank accounts. The Bill replaces the existence of project bank accounts with a regime for ‘project trusts’, with some distinct differences to what is currently in place. Particular changes include the removal of the disputed funds account and new powers for the QBCC to audit and freeze project trusts. Prescribed subcontracts and subcontracts with related entities may also require a project trust.

- Security of payment. The Bill introduces a requirement for a head contractor’s payment claims to be accompanied by a ‘supporting statement’, declaring that subcontractors have been paid all amounts owed to them or explaining any shortfall, similar to the position in New South Wales. The Bill also introduces additional measures for claimants to enforce adjudication decisions through the making of a ‘payment withholding request’ on a higher-tier party or by registering a charge over the property on which the work was carried out if the respondent (or a related entity) is also the owner.

- Certification. The Bill introduces a demerit point system for building certifiers, which can result in a building certifier being disqualified from holding a licence.

- Executive liability offences. The Bill introduces liability for executive officers for project trust offences by the company, and contains an executive liability offence of failing to exercise due diligence to ensure that a company licensee complies with the QBCC’s minimum financial requirements.

- Architects and engineers. The Bill also provides investigators carrying out investigations into conduct by architects or registered professional engineers with additional rights of entry, search powers, and powers of seizure.

Phased implementation of project trusts

Currently, project bank account contracts are head contracts between $1 million and $10 million, where the Principal is the State, or a State authority that has decided a project bank account is to be established, where more than 50% of the contract price is for building work.

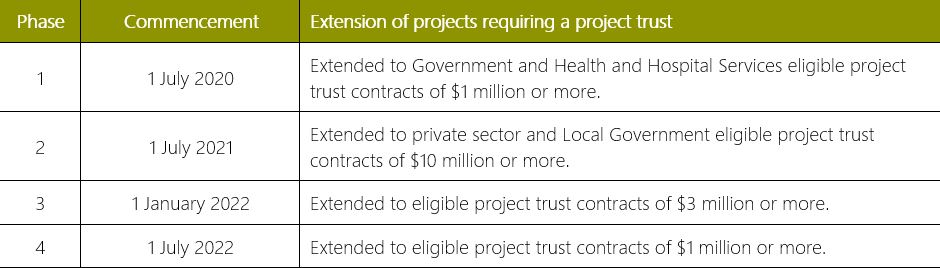

The explanatory notes and draft regulations to the Bill set out the Government’s intended phased implementation of project bank accounts, or ‘project trusts’ (and retention trusts), which are the terms now used in the Bill. The Government’s intended phased implementation is as follows:

What is next?

The Bill has been referred to Parliament’s Transport and Public Works Committee for consideration.

Further information

A copy of the Bill can be found here. A copy of the explanatory notes can be found here.

For further information on any of the issues raised in this alert please contact the below authors: