JobKeeper summary

The Federal Government has introduced the JobKeeper scheme to assist employers to keep their employees on during the COVID-19 outbreak despite its economic consequences.

In short, the scheme entitles eligible entities who have suffered a specified substantial decline in turnover to a payment of $1,500 per fortnight (before tax) for salary or wages paid to eligible employees. The wage subsidy is available to eligible entities for 13 fortnights, from the fortnight commencing 30 March 2020 to the fortnight ending 27 September 2020, with applications to participate in the scheme open from 20 April 2020.

The legislative scheme for the JobKeeper payment is unusual in that the main act only sets out a skeleton framework, and then provides for the Treasurer to make rules for the operation of the scheme to be administered by the ATO. In this circumstance, there are a number of provisions, including the eligibility rules, which are yet to be clarified.

Please note that the information below is based on the rules, statements and fact sheets that Treasury and the Commissioner of Taxation have already released.

It is certain that these rules will be updated from time to time by legislative instrument (or changes), which will likely materially affect some of the comments we have made below. This is an unfortunate, but necessary consequence of the speed with which the Federal Government is attending to this unprecedented stimulus package.

We will keep updating this information as Treasury and the Commissioner release more details.

Availability of JobKeeper payment

Since 30 March 2020, employers have been able to register their interest to participate in the scheme and subscribe to receive JobKeeper payment updates.

To receive the JobKeeper payment, an entity must:

- be an eligible entity, which includes meeting the requisite decline in projected or actual turnover;

- have eligible employees, with respect to whom the wage subsidy will be paid; and

- follow the correct application and reporting processes.

We have summarised these points below.

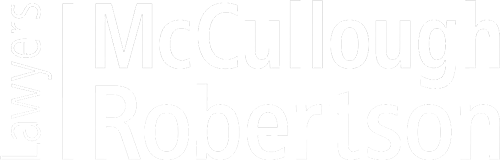

Eligible Entity

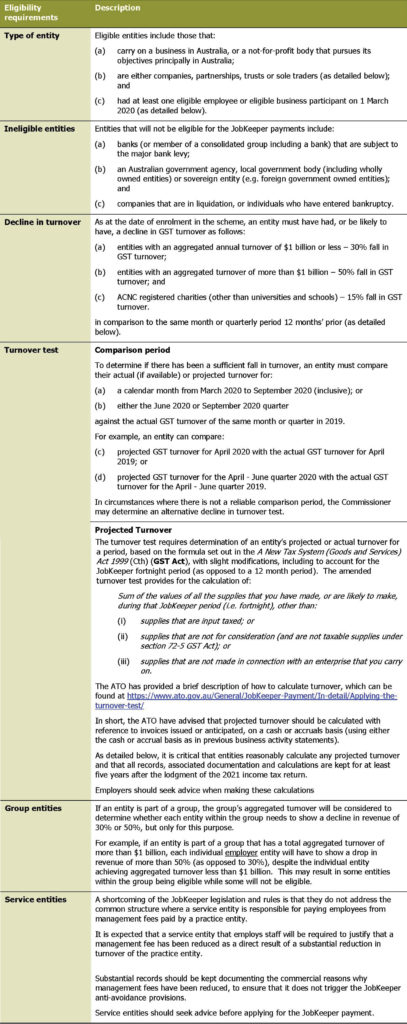

Eligible employees

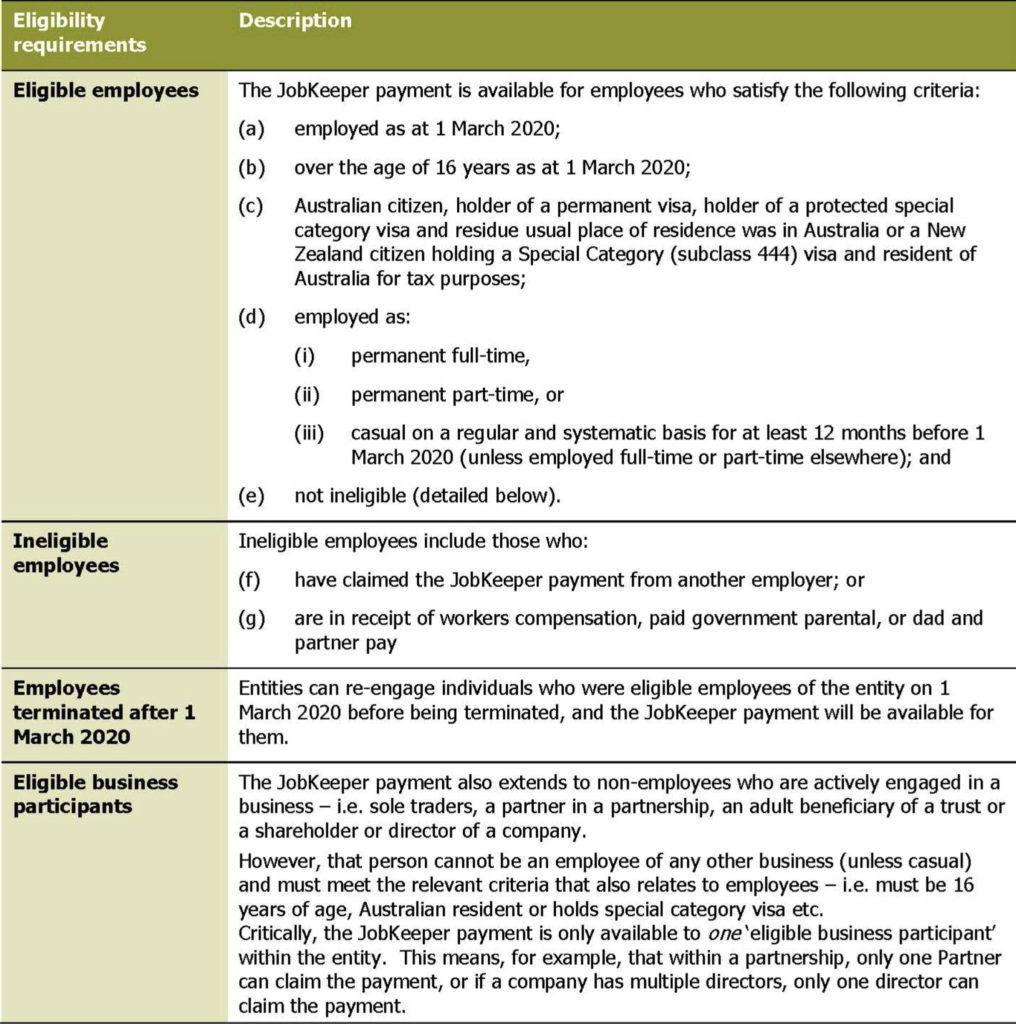

Application, management and reporting

Frequently asked questions

What if my projected turnover does not align with my actual turnover?

As detailed above, an entity can become eligible and start to receive the JobKeeper payment based on a projection of their GST turnover for a period, and will subsequently be required to report their actual turnover.

In the event that the projected turnover does not align with the actual turnover (whether by a close margin or significant margin), this will not affect the entities eligibility to be in the scheme provided that the initial projection was correctly calculated and is reasonable. It is therefore critical to maintain detailed and accurate records setting out how the projected turnover was calculated and any associated documentation. To date, the ATO have only briefly outlined relevant consideration to calculate projected turnover (see here), which makes detailed record keeping which can establish the reasonableness of a calculation even more important.

Where possible, we recommend that the assistance of a third party be obtained to calculate projected turnover.

What if the ATO finds that I was not eligible or overpaid?

The JobKeeper legislation and rules, and the taxation administration legislation set out consequences for the wrongful payment or overpayment of JobKeeper.

As a starting point, if the Commissioner determines that an entity has been wrongfully paid or an overpayment has been made, the entity will be required to repay the amount – this will be due to the ATO on the date that the payment was first made. The taxation general interest charge (GIC) will compound daily on the overpaid/wrongfully paid amount until it is repaid to the ATO.

In addition, any overpayment will be treated as a tax-related liability under the taxation administration legislation, which effectively allows the ATO to use its extensive debt recovery powers to recoup the amount, including (for example) issuing a garnishee notice to recoup the amount from a third party.

Finally, the JobKeeper legislation explicitly includes anti-avoidance provisions addressing the event that an entity enters into a scheme for the dominant purpose of claiming the JobKeeper payment (or increasing the available payment). In this circumstance, the Commissioner may determine that the entity was never entitled to the payment such that the whole amount must be repaid, and may establish that the entity is liable to either civil or criminal penalties.

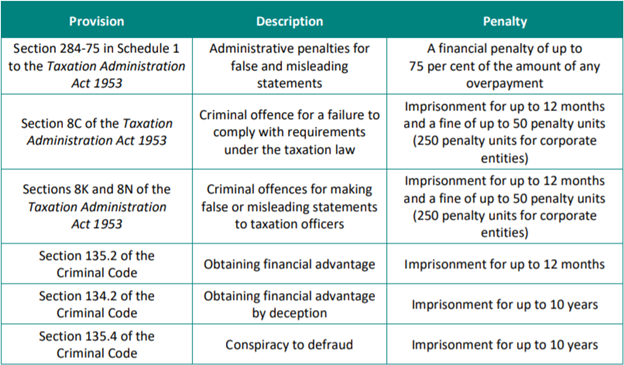

The civil and criminal penalties which might be applied by with respect to the JobKeeper payment were set out by the Treasury in its JobKeeper Payment – Protecting Integrity Fact Sheet, as shown below.

For further information, please contact our authors below.

This publication covers legal and technical issues in a general way. It is not designed to express opinions on specific cases. It is intended for information purposes only and should not be regarded as legal advice. Further advice should be obtained before taking action on any issue dealt with in this publication.