[vc_row][vc_column][vc_column_text]The ASIC regulatory sandbox, established in December 2016, provided a licensing exemption to allow eligible fintech companies to test certain products or services for up to 12 months without an Australian financial services licence (AFSL) or Australian credit licence (ACL). The Australian Government enhanced regulatory sandbox (ERS) commenced on 1 September 2020 and superseded the ASIC sandbox. The ERS expands on the ASIC sandbox and allows for a longer testing period (of up to 24 months) for a broader range of financial services and credit activities and for a wider range of businesses (including existing AFSL and ACL holders).

Set out below is a checklist to consider if you want to take advantage of the enhanced ERS licensing exemption (ERS exemption).

You only need an exemption if you need a licence

Firstly, it is important to consider whether you will need an AFSL or ACL in the first place.

An AFSL may be required if you intend to provide financial services to clients. This may include, for example, where you:

- provide financial product advice to clients, for example, giving a recommendation to clients or the general public to purchase a financial product;

- deal in a financial product, for example, buying or selling shares on behalf of a client or issuing interests in a managed investment scheme;

- provide a non-cash payment facility; or

- provide a custodial or depository service, for example, holding a financial product, or a beneficial interest in a financial product on trust for a client, including in operating an unregistered managed investment scheme.

Financial products include things such as shares, interests in managed investment schemes, insurance products, bonds, superannuation, derivatives, foreign exchange contracts, non-cash payment facilities and margin lending facilities.

An ACL, on the other hand, may be required if you intend to engage in credit activities in relation to a type of credit or consumer lease to which the National Credit Code applies. For example, if you propose to provide loans to an individual or strata corporations for personal, household or domestic purposes or assist natural persons or strata corporations to enter into consumer leases.

There are also various exemptions to the AFSL and ACL requirements other than the ERS exemption which may also be applicable to you. If you are unsure whether you will need an AFSL or ACL to operate, you should seek professional advice.

Are you eligible to play?

Assuming you do require an AFSL or ACL to operate, you will then need consider whether you satisfy the eligibility criteria to be able to rely on the ERS exemption. As with the superseded ASIC sandbox, unlicensed Australian businesses and locally registered foreign companies are eligible to participate. The ERS also extends the eligibility criteria to licensed businesses testing new services that they are not currently authorised to provide.

The ERS exemption is limited to the following services and activities (items in bold have been extended from the supereded ASIC sandbox) which satisfy both the net public benefit and innovation tests, as discussed below:

- for wholesale clients, providing financial services (including advice, dealing and issuing) related to all financial products except derivatives and margin lending products.

- for retail clients:

- providing advice, dealing in or distributing in relation to the following products:

- deposit products (ADI issued);

- non-cash payment products (ADI issued);

- general insurance (excluding consumer credit insurance);

- life insurance;

- superannuation products;

- interests in simple managed investment schemes;

- Commonwealth debentures, stocks and bonds;

- securities (shares and bonds) listed on the official list of a prescribed financial market or an approved foreign market; and

- crowd-sourced equity securities;

- issuing credit, or providing credit advice or intermediary services;

- issuing general or life insurance as an agent of the insurer;

- issuing a non-cash payment facility; and

- providing a crowd-funding service.

- providing advice, dealing in or distributing in relation to the following products:

When you are ready to get your hands dirty

In order to rely on the ERS exemption, you must lodge a valid notification form with ASIC. For financial services, this is the ‘Notification to use the ERS exemption to test eligible financial services’ and for credit activities, this is the ‘Notification to use the ERS exemption to test eligible credit activiites’. These forms require you to provide information on:

- the probity, fitness and propriety of you, your officers, your controllers, the officers of your controllers and your significant decision makers;

- the net public benefit test – you must adequately explain why exempting each eligible financial service, financial product or credit activity will result, or be likely to result, in a benefit to the public. The benefit must outweigh any detriment to the public that will result, or be likely to result, from exempting that service; and

- the innovation test – you must adequately explain why each eligible financial service, financial product or credit activity is considered either new or a new adaptation or improvement of another service.

ASIC will rely on the information you provide in the notification and will not ordinarily seek further information from you about your notification during the assessment of your notification. ASIC has 30 calendar days to assess your notification. It is intended that ASIC will write to you within this period to advise whether you are or are not able to rely on the ERS exemption and will give you a statement of reasons if you cannot rely on the exemption (for example due to failure to meet conditions or previous misconduct). If ASIC does not respond within the 30-day period, then the exemption is taken to start on the 31st day after the date you lodged your notification with ASIC.

Playing nice – what you need to do while relying on the ERS exemption

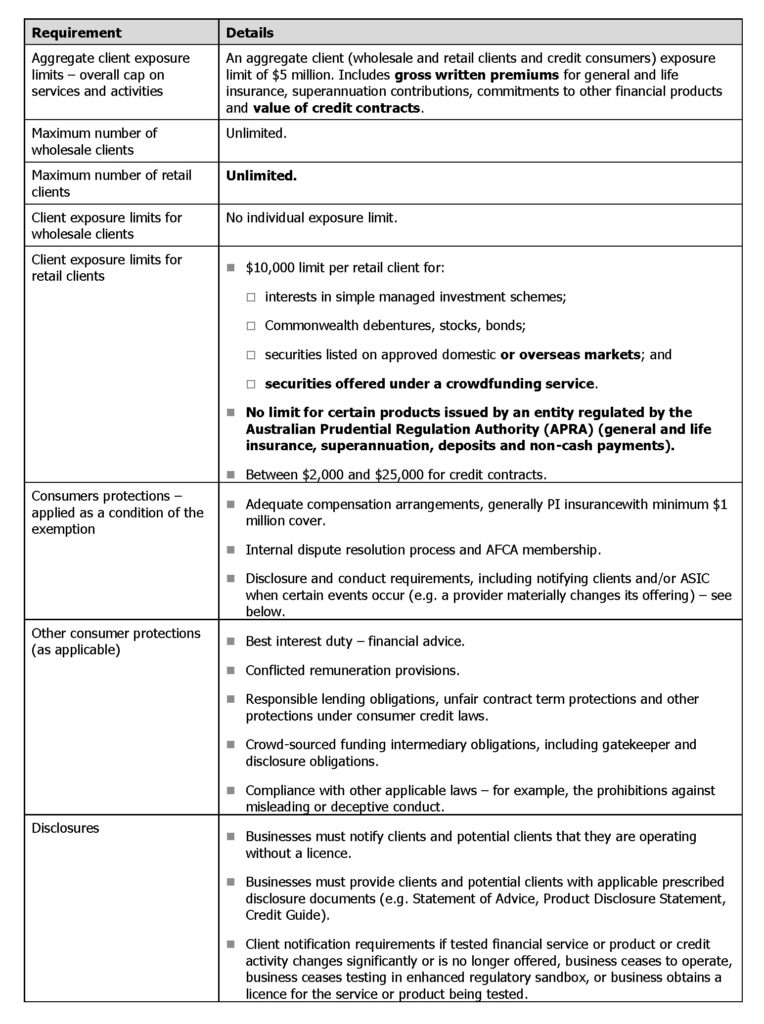

If you are relying on the ERS exemption, you must comply with the following testing parameters, exemption conditions and consumer protection mechanisms (items in bold have been extended from the supereded ASIC sandbox):

These requirements reflect the fact that even if you are relying on the ERS exemption, you are still providing financial or credit services.

When to think about getting a licence

Before the end of your exemption period, you must decide whether you will cease operations or apply for a licence or authorisation. If you decide to apply for a licence or authorisation, you must apply adequately in advance of the end of your testing period to allow ASIC enough time to decide on your application before the end of your exemption period. ASIC currently recommends that you allow at least six to nine months for this process.

What to do when the exemption ends

Your exemption period will end after 24 for months, or earlier if:

- you breach any of the conditions attached to your exemption or to another exemption you have;

- you obtain an AFSL or ACL which, or are appointed as an authorised representative or credit representative and such authorisation, covers the provision of the same financial services or products, or credit activities, that you are testing under your ERS exemption;

- ASIC determines that you can no longer rely on the exemption for any of several reasons, for example if they find that:

- the service is not innovative;

- you have not satisfied the fitness and propriety requirements;

- you have failed to act efficiently, honestly and fairly;

- the current ERS exemption is an attempt to continue or recommence an exemption that was previously obtained by another person;

- you have failed to comply with the best interest obligations;

- the provision of the service has resulted in significant detriment to one or more persons; or

- ASIC have cancelled a previous exemption; or

- you lodge a written notice with ASIC confirming that you wish to cease relying on the ERS exemption.

The 24 month exemption period cannot be extended, paused or reset.

At the end of the exemption period, ASIC requires that you provide them with a short report within two months which sets out details of your experience while testing your financial service or credit activity.

For further information on any of the issues raised in this article, please contact the team below.[/vc_column_text][/vc_column][/vc_row]