The Payment Times Reporting Scheme begins on 1 January 2021. While aimed at assisting small businesses when engaging with large business customers, the Scheme has significant implications on negotiated payment terms and compliance obligations for large business customers.

Following two inquiries by the Australian Small Business and Family Enterprises Ombudsman in 2017 and 2019 into the payment times and practices of large businesses, the Federal Government has introduced the Payment Times Reporting Scheme. The Scheme is comprised of two Bills, which received royal assent in September and October 2020, and will come into effect on 1 January 2021. A summary of the Bills is outlined below.

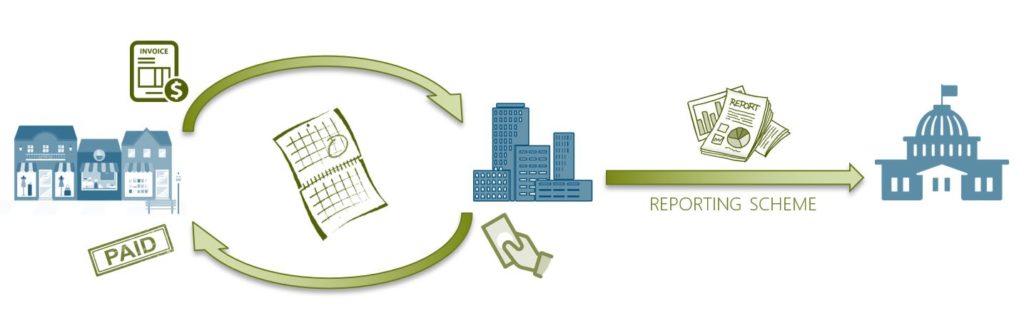

The primary objective of the Scheme is to create greater transparency by imposing obligations on large businesses to report on their payment terms and practices in relation to small business suppliers. Such transparency is aimed at addressing the impact of delayed payments on small business cash flows, assisting small businesses to make informed decisions as to which large business customers to engage with, and to create incentives for improved payment times and practices.

What do large business customers need to know?

Organisations that are ‘constitutionally covered’ (as defined under the Scheme), carry on an enterprise in Australia, and generate income over $100 million per year will be required to comply with the Scheme.

Large organisations of this nature will need to keep the Scheme in mind when negotiating payment terms with or on behalf of small suppliers, as well as from a compliance perspective.

Although the Scheme does not expressly require small suppliers to be paid within a specific period, the Explanatory Memorandum to the Bill considers a payment period beyond 30 days to be “long” and a “significant problem” for small businesses.

The reporting requirements will potentially have significant impacts on the compliance burden and costs for large businesses operating in Australia. Large business customers should start preparing now by determining whether they will be required to report, and assessing what operational processes will need to be put in place in order to meet the compliance requirements.

It is expected that the increased accountability for payment terms disclosure will further encourage the adoption of supply chain management initiatives, and data and system integrity reviews to monitor and manage compliance responsibilities.

Businesses should also consider various financial and reputational risks that may flow from the publicly available register where reports will be disclosed, or a potential breach of the Scheme.

Summary of the Scheme

For further information on any of the issues raised in this alert, please contact one of authors below.

Thanks to Emily Stone (Lawyer) for her assistance in putting this article together.