The Australian energy sector has evolved considerably in the last 12 months. Following the Federal election, we saw Prime Minister Anthony Albanese acknowledge Australia’s significant potential to become a renewable energy superpower and enact a series of energy policies aimed at driving the country forward to 2030 and beyond.

After a period marred by a divided, state-by-state approach to renewable energy development and emissions reduction, this shift has been widely welcomed by industry and investors. Backed by this unified approach, the sector can now focus firmly on energy transition and decarbonisation.

However, with the energy storage push and the increasing quantity of expected renewable connections in 2023, renewable energy proponents still face challenges, including grid access, reliability and stability, competing land use, and the expected labour shortage moving into the expansion phase. We explore these themes in further detail throughout this publication.

State of play

The talk around the Australian market has focused on the surging price of electricity, particularly the spike in prices in May/June 2022. Australia’s energy inflation has arisen due to some unusual circumstances including that some of the major baseload generation units were in unscheduled shutdown for repairs and the fluctuations in the Australian export gas price which has been elevated due to the Ukraine War. This has forced a number of retailers out of the local market and led the Federal Government to impose gas and coal price caps with mixed results.

Despite this energy market volatility, we have seen several new projects either being developed or coming online, including:

| Project | Description | Capacity |

| Western Downs Green Power Hub | Located in Dalby (QLD), the Western Down’s Solar Farm came online in 2022, becoming Australia’s largest solar farm. | 460MW |

| Port Augusta Hybrid Wind-Solar plant | The South Australian hybrid facility, initially green-lighted in 2019, and was completed in 2022 with 210MW of wind facilities and 107MW of solar capacity. | 317MW |

| Ballarat Energy Storage System | The completion of the BESS (one of the country’s first battery storage facilities), has spurred on a wealth of storage production approval and construction through 2022 and into 2023 – highlighting the country’s progression with energy storage facilities. | 30MW |

Connecting to the grid, however, remains an issue. The Integrated Systems Plan from the Australian Energy Market Operator (AEMO) forecast that Australia’s power grid will lose approximately 14GW of traditional coal-fired plants by 2030. This will have a material impact on the grid, given the grid is set up to facilitate traditional baseload export from relatively few locations, rather than a large number of smaller renewable export capacities from diverse regional locations. Consequently, the 2022 report also suggested that to service the expansion of wind and solar farm capacity, the grid powering Australia’s eastern seaboard would need approximately 10,000km of new transmission lines by 2050.

Federal policy update

Following the Federal election in May 2022, the new Albanese Government quickly delivered on its election promise to enshrine reduction targets into legislation. Putting the market on notice, the Climate Change Act 2022 (Cth) was enacted in September 2022, ultimately legislating the greenhouse emission reductions targets of:

- 43% by 2030; and

- net-zero by 2050.

We have seen a raft of additional proposals introduced, including the much-discussed Powering Australia Plan. The Plan replaces the previous Long-Term Emissions Plan and has several key features the Government believes will accelerate Australia’s progress toward decarbonisation. Put simply, the primary focus under the scheme is its $20 billion investment pledge to expand and re-develop Australia’s grid. It also provides for:

- $15 billion in funding to establish the National Reconstruction Fund ($3 billion of which will be attributable to the supporting of the renewables sector through a range of financing options);

- $224.3 million in funding through to 2027/28 to deploy approximately four-hundred community batteries; and

- $102.2 million in funding through to 2027/28 to fund community solar bank programs.

- With further active steps including funding university studies on the integration of variable renewables into Australia’s power grid, we can expect to see further measures around grid maintenance, refurbishment, and battery storage in the near term.

Hydrogen

At the inaugural Energy and Climate Ministers Council Meeting in February 2023, the Federal Government promised a review of our National Hydrogen Strategy to ensure that Australia remains firmly on the path to becoming a global leader by 2030.

This review comes at a critical time, with countries around the world doubling down to secure the first-mover advantage. We have seen significant policy advancements from around the world, including:

- the United States’ announcement of the Inflation Reduction Act of 2022, which will enable clean hydrogen production facilities to earn a USD3/kg production tax credit;

- the European Commission’s announcement of its Green Deal Industrial Plan, including a ten-year guaranteed premium for producers of renewable hydrogen; and

- India has announced an incentive plan of 174.9 billion rupees (AUD$3.192 billion) to promote green hydrogen and become a major exporter.

With competition heating up, a revitalised strategy will allow us to continue to develop our economy and become a dominant player in the production and export of hydrogen.

State Policy Update

State Governments have also continued their push to meet their respective emission targets through several measures, including:

Queensland

In September 2022, the Queensland Government introduced its Energy and Jobs Plan which outlined the state’s path toward renewable rejuvenation. Under the plan, the Government has committed to 70% renewable energy by 2030 and 80% by 2035. Similar to the Federal model, this plan aims to diversify its reliance by:

- converting coal-powered stations into ‘clean energy hubs’; and

- developing new foundational pumped hydro energy assets.

Of most interest for Queensland proponents, are the foundational hydro energy assets proposed in the Borumba Dam and Pioneer Burdekin locations. Once operational it is anticipated that these projects will generate up to 7GW of electricity.

This push for storage in Queensland has complimented the strong focus by the Commonwealth on battery storage and includes the proposed Ipswich energy precinct.

New South Wales

In October 2022, New South Wales launched an Electricity Infrastructure Roadmap. Under the roadmap, the New South Wales Government forecast the construction of 12GW in renewable connections by 2030. In keeping with the nation’s continued prioritisation of storage facilities, the New South Wales Government have also planned for 2GW of pumped hydro energy storage.

Further, the New South Wales Government have also declared that the Hunter Renewable Energy Zone (REZ), being the State’s fourth REZ, will include an offshore-wind facility.

The Roadmap also includes a tender and auction process aimed at retiring the State’s coal fired power stations. The Government’s plan is undoubtedly Australia’s most ambitious, and intends to significantly assist the Federal Government in meeting its national emission targets.

Victoria

Victorians were promised plenty in 2022, with the State visiting the polls in both state and federal elections. One such pledge came in September 2022, when the Victorian Government announced its plan to introduce Australia’s largest energy storage targets. Under the proposed targets, which forecast a $1.7 billion investment, Victoria expects 2.6GW of renewable storage capacity by 2030 increasing to 6.3GW by 2035.

In addition to the storage solutions, the Victorian Government pledged $119 million from the state’s REZ fund, into a 125MW battery and grid forming inverter. A further $38.2 million has been announced in support of four other projects: the Terand BESS; Bioenergy projects in Gippsland and Barwon; and an Electrolyser trial in Wollert.

Western Australia

In November 2022, Western Australia set the record for the highest instantaneous renewable energy share with a peak of 81% (61% of which derived from rooftop solar), trumping the 79% benchmark previously set in September 2021. Such an accomplishment was of particular importance to AEMO, given the grid’s isolation and lack of associated battery storage facilities. It also came in a year when the Western Australian Government declared the State’s coal-fired plants at Muja and Collie would close by 2029.

With an eye toward fast-tracking renewable developments, the Western Australian Government additionally announced its updated approach for approving ‘green energy’. Anticipated to be operational by mid-2023, the Government has committed $22.5 million to streamline approvals for green energy proposals as well as establishing expert panels and additional teams to assist in supporting Government agencies and assessing appropriate proposals.

The State progressions as outlined above demonstrate the significant investment required in storage facilities in 2023 and beyond.

Sector activity

New renewable energy connections

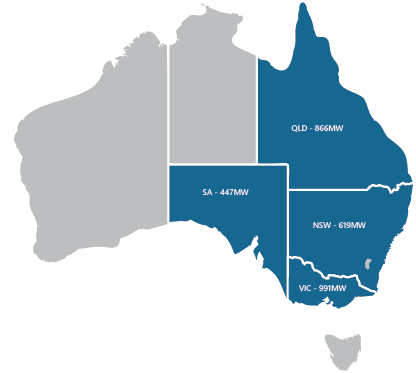

Australia has made steady progress toward 2030 with 2.9GW of new connections in 2022. However, while 2022 saw a 137MW rise in annual connections, there were seven fewer large-scale projects than in the previous year.

The 2.9GW of new connections is not entirely indicative of the rise in connections, given the somewhat inhibited operation capacity of the projects. Regardless, given the newly legislated reduction targets for 2030 and 2050, the Australian market must significantly increase the rate of connections. In real terms, it must connect on average 6GW per year if it is to have any chance of achieving its 2030 targets.

Queensland also saw a $160 million commitment from the Clean Energy Finance Corporation to assist with the development of the Southern Downs REZ. This concessional financing is the first contribution to construction costs associated with REZ assets and is indicative of financing intentions in 2023.

Victoria saw the most connection progress nationwide and continues to utilise their geographical advantage with Stage 1 of the Golden Plains Wind Farm scheduled for commencement in Q1 2023. In what is expected to be one of Australia’s largest windfarms, upon its proposed 2025 completion it will connect 1,300MW of capacity to the grid.

New South Wales’ 619MW of new connections was not the only development in 2022. Under the State’s roadmap, and in consultation with the Australian Energy Regulator, Akaysha Energy on behalf of the Energy Corporation of New South Wales is expected to commence construction of the Waratah Super Battery Project in early 2023. With an anticipated completion date of mid 2025, the Super Battery Project promises to provide at least 700MW of connection capacity, making it the largest and most powerful battery in the world.

Where to from here?

With the Federal and State Governments aligned and firmly pushing for rapid decarbonisation, new challenges are emerging:

- Labour shortages: Australian Electricity Workforce 2022 modelling suggests that if Australia is any chance of achieving its legislated targets, a further 12,000 sector workers are needed by 2025;

- Environmental risks: the speed and volume of renewable projects has led to a somewhat expeditious approach to approval processes within previously untouched conservation areas. With 6GW per year needed to meet Australia’s 2030 targets, one can expect in the year ahead, a dramatic increase in renewable production and project approvals. While REZ’s are slowly leaving their infancy, there appears to be a concern around the inconsistency in approach between how the Federal and State governments approach environmental issues and considerations. While offshore wind projects are touted as necessary for providing pivotal boosts to emission reduction, they themselves face environmental challenges, with projects requiring differing impact assessments by the State and Federal Governments requirements. With the breadth of threatened species growing and the underwater impacts of offshore projects a work in progress, the construction of large-scale wind projects face similar challenges moving into 2023.

In 2022, we asked how fast Australia would transition. The past year has demonstrated a significant change of gear toward 2030, with energy storage facilities emerging as the key proponent of the country’s transition. With new plans to tackle old problems, the renewable energy sector can expect significant developments in the coming year but should remain cautious of the effect of the country’s ongoing infrastructure hurdles.

For more information on this topic, or to explore other articles from our 2023 edition of Emerging Issues for the Australian Energy and Resources Industry, click here.