Why avoiding underinsurance is important

Like personal insurance, reviewing your business insurance is essential. It’s generally effortless to do and provides peace of mind for you and your business. If access to advice is required, subject matter experts, such as McCullough Robertson are easy to connect with to confirm your position and where required, update, amend or switch providers to ensure your coverage best suits your current and future needs.

Our clients are often surprised to discover that their assets are not covered to full value under their current insurance policy – leaving owners financially exposed in the case of unforeseen events that cause damage. Financial impacts are often felt elsewhere in the business as owners find themselves having to cover a gap payment to fund the rebuild, repair, or replace process outside of their coverage.

In this article, we look at the claims process and how to make sure that your business assets are fully insured and how best to avoid the consequences of underinsurance.

The claims process

In the event of an insured loss, the basis of settlement clauses in an Industrial Special Risks (ISR) Policy determines how a claim will be paid. There are two basis of settlement clauses available in the insurance market.

1.1 The first is ‘reinstatement value’. Claims are paid based on the cost necessary to replace, repair or rebuild the damaged property (for example buildings, machinery, plant) to a condition substantially the same as but not better or more extensive. In other words, claims are paid on a ‘new for old’ basis.

1.2 The second is ‘indemnity value’ (or market value). Claims are assessed by reference to the cost necessary to replace, repair or rebuild the damaged property to a condition substantially the same as but not better than at the time that the damage occurred taking into consideration age, condition and remaining useful life. The claim value will be calculated as the replacement cost, less any allowance for wear, tear, depreciation and betterment of the property representing the value immediately before the loss.

1.3 Typically, the basis of settlement clause will operate on a reinstatement value (new for old) basis for most insured property. ISR policies might also specify alternative bases of settlement with respect to other property including raw materials, manufactured goods and computer equipment.

What is under insurance (co-insurance)?

Under insurance (also known as co-insurance or average) may apply if the damaged property has been under-insured or insured for less than its replacement value. When an insured business under-insures its property, either inadvertently or to reduce its premium costs, co-insurance may apply. This means that the insured may not receive full compensation in the event of a loss occurring.

It is common for insurers to include a ‘co-insurance clause’ in an ISR policy. The consequence is that in the event of a claim could be significant for an insured’s business, as explained further below.

The ‘Schedule of Declared Values’ in an ISR policy is relevant to the application of the ‘co-insurance clause’. The properties and values declared on this Schedule are a key variable in the application of any ‘co-insurance’ clause. Consequently, not having accurate sums insured for all insured assets will have an immediate effect on the adjustment of any loss.

How does co-insurance work?

There are two aspects to co-insurance: when it applies and how it applies to insured losses.

1.4 Co-insurance usually only applies if the:

(a) claim value is less than 5% of your declared asset value; or

(b) sum insured is less than 85% of the actual value of the insured asset.

1.5 This means that co-insurance becomes an issue for larger losses and where the declared value of the asset is less than 85% of its actual replacement value.

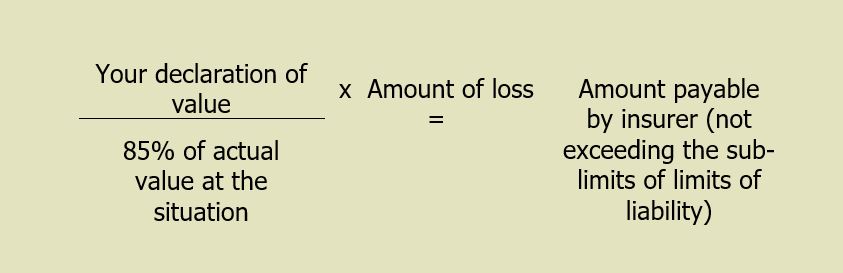

1.6 When co-insurance applies, the insurer uses the following formula under the co-insurance clause to reduce the amount it will pay for the loss.

In other words, insurers allow 15% leeway in terms of declared values before they will apply a co-insurance penalty. In real terms, the effect of underinsurance is that there will be a proportional reduction to the value of a loss based on a declared value that is already inadequate to cover replacement costs.

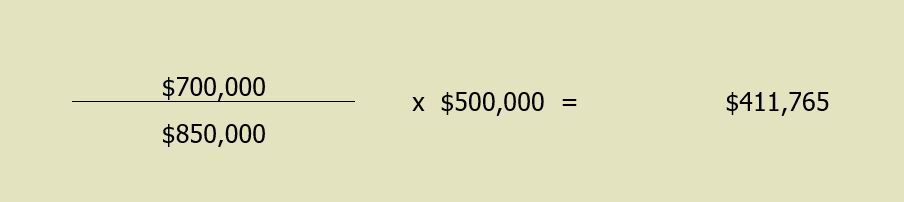

1.7 The operation of the above formula is demonstrated by the following calculations involving a property damage claim of $500,000. In this example the property was insured for $700,000 but its actual value was worth $1 million.

1.8 There is an uninsured loss of $88,235 ($500,000 less $411,765) in this example.

How to avoid a co-insurance penalty

As a starting point, an assessment of the business and its risk profile (exposures) should be undertaken to better understand the most appropriate insurance for the business.

From there, to ensure the sums insured of the business accurately reflect the true replacement value of the business’s buildings and assets, those sums should be reviewed at renewal time or earlier in the event of any changes to the business, particularly if more assets are acquired during the policy period.

As a business evolves, its insurance needs to evolve with it. That review should involve the careful consideration of the costs to replace stock and equipment or cost to rebuild, depending on what is being insured.

Finally, insureds may seek to have the ‘coinsurance’ clause deleted to avoid being penalised in the event of a claim. Policies are available in the market which do not impose what can be considered an onerous obligation with respect to the declaration of property values and major impediment in restoring property after a loss.

How we can support you

McCullough Robertson and our insurance advisory service, Allegiant IRS, can assist you with a review and assessment of your current insurance policy to ensure you have appropriate cover. We can also guide you through the process of redesign, placement and renewal of insurance cover for your business to ensure that it best fits your current or anticipated risk profile.

Related insights

Business Pack versus Industrial Special Risks (IRS) policy insurance

Business interruption insurance – covering the bottom line

Business Packs versus Insurance Special Risks policy guide