A sigh of relief for Australian companies In August, the Federal Government passed legislation allowing companies to electronically execute documents (including deeds) under section 127 of the Corporations Act. The Treasury Laws Amendment (2021 Measures No 1) Act 2021 (Act) was enacted on 14 August 2021 to temporarily amend the Corporations Act 2001 (Corporations Act) until 31 March 2022. …

Expertise Archives:

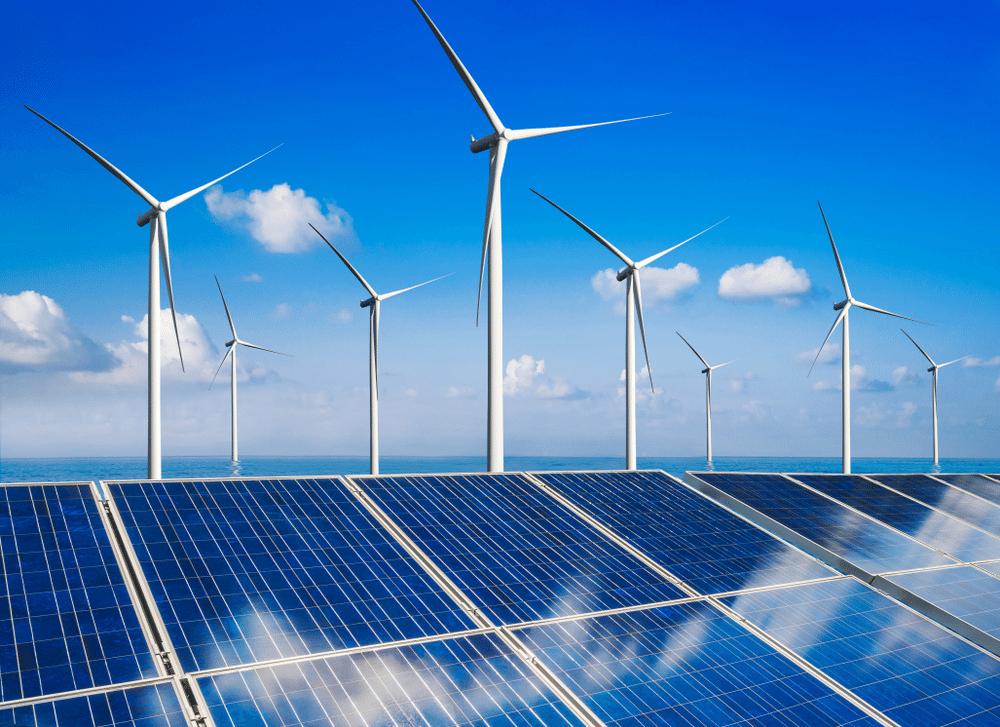

Australia’s proposed framework for offshore wind and power

The Australian Government has taken the first step towards the development of a new offshore renewable energy industry through the introduction of the Offshore Electricity Infrastructure Bill 2021. This Bill provides a regulatory framework to support the construction, installation, commissioning, operation, maintenance and decommissioning of electricity transmission and renewable energy infrastructure in the Commonwealth offshore …

Continue reading “Australia’s proposed framework for offshore wind and power”

Key lessons in Australian crowd-sourced funding.

From set up to shareholders- understand your legal obligations to ensure success. Part 2 of 5: managing the logistics of increased shareholders In this, the second of a series of five articles, McCullough Robertson’s start-up expert, Partner Ben Wood discusses some of the options available to a crowd-sourced funding (CSF) company to handle its members …

Continue reading “Key lessons in Australian crowd-sourced funding.”

Key lessons in Australian crowd-sourced funding.

From set up to shareholders- understand your legal obligations to ensure success. Part 5 of 5: getting the most out of your directors In this, fifth, and final, article of the series, McCullough Robertson’s start-up expert, Partner Ben Wood shares his insights into building a board of directors and facilitating director and shareholder meetings. Director …

Continue reading “Key lessons in Australian crowd-sourced funding.”

Key lessons in Australian crowd-sourced funding.

From set up to shareholders- understand your legal obligations to ensure success. Part 4 of 5: mechanisms to control how shareholders manage shares In this, the fourth of a series of five articles, McCullough Robertson’s start-up expert, Partner Ben Wood examines some of the mechanisms a crowd-sourced funding (CSF) company can include in its constitution …

Continue reading “Key lessons in Australian crowd-sourced funding.”

Key lessons in Australian crowd-sourced funding.

From set up to shareholders- understand your legal obligations to ensure success. Part 3 of 5: defining the rights and obligations of shareholders in a CSF company One of the complexities that we have dealt with in working with equity crowd-sourced funding (CSF) companies is reconciling the interests of existing shareholders with those of the …

Continue reading “Key lessons in Australian crowd-sourced funding.”

Key lessons in Australian crowd-sourced funding.

From set up to shareholders- understand your legal obligations to ensure success. Part 1 of 5: an overview of crowd-sourced funding Since October 2018, the Corporations Amendment (Crowd-Sourced Funding For Proprietary Companies) Act 2017 (Cth) has allowed proprietary companies to raise capital through crowd-sourced funding (CSF) in return for equity in the company. Prior to …

Continue reading “Key lessons in Australian crowd-sourced funding.”

The benefit of hindsight – Supreme Court of Queensland provides guidance on Australia’s whistleblower regime

Protection of whistleblowers Preventing crime and misconduct is a fundamental and longstanding aim of corporate law enforcement. However, criminal conduct which occurs in the corporate sphere can be extremely difficult to detect and prove satisfactorily in Court. Such conduct can often be concealed by a complex web of transactions, non-written arrangements and misleading corporate records. …

Chimeric Therapeutics IPO

The 2020 global Zoom boom

The COVID-19 pandemic has brought unprecedented technological challenges, particularly our engagement with others through technology. Platforms such as, Zoom, Microsoft Teams, Cisco Webex, Google Hangouts Meet, Skype and BlueJeans have become increasingly popular worldwide among businesses and individuals. The global pandemic has changed the vast majority of the population’s behaviour patterns, particularly the manner in …

Privacy ‘must haves’ in a digitalised and data-heavy post-COVID economy

It’s been over six months since COVID-19 disrupted the day-to-day operations of businesses in Australia. As we near the end of 2020, many businesses have now fast-tracked digitalisation across their business models and activities, pivoted to new goods and service offerings, moved business operations and interactions online, distributed their workforce, and implemented COVID-tracing capabilities. While …

Continue reading “Privacy ‘must haves’ in a digitalised and data-heavy post-COVID economy”

NQ Minerals PLC

Cybersecurity in the post Covid workplace – stress testing your defences

WHO SHOULD READ THIS Business Owners, CEO’s, CFO’s, CIO’s, CISO’s, Executive Managers, Insurance and Risk Managers. THINGS YOU NEED TO KNOW Cybersecurity must be addressed in the same way as any other business risk to protect critical processes and functions and to ensure business continuity. A robust cybersecurity framework should be supported by a carefully …

Continue reading “Cybersecurity in the post Covid workplace – stress testing your defences”

Business Interruption Insurance – COVID-19 Test Case creates opportunity for loss recovery

The outbreak of the COVID-19 pandemic in Australia and overseas has had a hugely damaging economic effect on the business community. Many of these businesses hold Business Interruption (BI) insurance and may have either had claims declined or not pursued them on advice that the policy did not respond. Alternatively, they may not have considered …

New rules and a bigger box – your toolkit for playing in the Australian Government enhanced regulatory sandbox

[vc_row][vc_column][vc_column_text]The ASIC regulatory sandbox, established in December 2016, provided a licensing exemption to allow eligible fintech companies to test certain products or services for up to 12 months without an Australian financial services licence (AFSL) or Australian credit licence (ACL). The Australian Government enhanced regulatory sandbox (ERS) commenced on 1 September 2020 and superseded the …

New Bill – Environment Protection and Biodiversity Conservation Amendment (Streamlining Environmental Approvals) Bill 2020

[vc_row][vc_column][vc_column_text] WHO SHOULD READ THIS State Government entities. THINGS YOU NEED TO KNOW The Federal Government has introduced a bill that proposes a number of changes to the EPBC Act (focused especially on the operation of bilateral agreements in NSW). The Independent Review of the EPBC Act also remains ongoing and is expected to result …

Corporate Advisory Boards – try before you buy?

It is undeniable that the past few months have brought challenges and disruption to businesses around the world. As we begin looking to the future and evolving how we do business, we should be considering ways to remain resilient, help mitigate these difficult circumstances, and work to reset the compass. Bringing in expert advice, injecting …

Continue reading “Corporate Advisory Boards – try before you buy?”

Over the Wire Holdings Ltd

Prescient Therapeutics Limited

Seer Security Pty Ltd sale to Tesserent Limited

McCullough Robertson has successfully led the sale of Seer Security’s Melbourne and Canberra based businesses to Tesserent Limited (ASX: TNT). With Seer Security’s cybersecurity capabilities focused on Government-certified delivery of Assurance and Governance, Risk and Compliance and software development, this deal significantly strengthens Tesserent’s cybersecurity services and delivery to Australian Federal Government departments and agencies. …

Continue reading “Seer Security Pty Ltd sale to Tesserent Limited”

Overview of Australia’s regulatory framework

Business dealings in Australia are controlled by a large number of regulators. These regulatory bodies have jurisdiction at both the Federal and State level. Australia’s regulators have a broad remit to oversee the conduct of businesses in a wide range of sectors, from financial services to energy infrastructure. Australia’s corporate regulators are creatures of statute. …

Continue reading “Overview of Australia’s regulatory framework”

Rethinking tax reform – it’s now or never

It is now 5 years since the Federal Government released it’s Re:think paper on tax reform, aimed at ‘beginning a dialogue on how [to] create a tax system that supports higher economic growth and living standards, improves international competitiveness and adjusts to a changing economy’[1]. Although the release of the paper stated that the current …

Continue reading “Rethinking tax reform – it’s now or never”

Emerging Issues: Australian Technology, Media and Telecommunications Sector Insights

[vc_row][vc_column][vc_column_text] We are pleased to bring you the July 2020 edition of Emerging Issues for the Technology, Media and Telecommunications (TMT) sector. In this Emerging Issue, we take an in-depth look at: the implications of the recent Data Protection Commission v Facebook Ireland Limited (C-311/18) decision and what it means for Australian businesses sharing data …

FIRB Reforms Article Series – Part 3: FGIs

Proposed exemptions to the definition of ‘Foreign Government Investor’ welcome news for private equity funds and institutional investors. We have been unpacking the upcoming changes to the Foreign Investment Review Board (FIRB) regime in our FIRB Reforms Article Series. This article considers the proposed amendments surrounding the definition of foreign government investor (FGI) which are …

Continue reading “FIRB Reforms Article Series – Part 3: FGIs”

FIRB Reforms Article Series – Part 2: Family Arrangements

Keeping it in the family: proposed reforms to FIRB’s treatment of family arrangements This part of our FIRB Reforms Article Series focuses on the Commonwealth Government’s proposal to prevent the use of family arrangements by foreign investors to circumvent the operation of the Foreign Acquisitions and Takeovers Act 1975 (Cth) (FATA). The release of the …

Continue reading “FIRB Reforms Article Series – Part 2: Family Arrangements”

Are loan books next on the block for Australia?

Australia, like everyone else, has experienced a seismic shock to its financial system and economy arising out of the Black Swan of COVID-19. And this time it is different, for an Australia which did not suffer in the same way as many other advanced economies arising out of the Great Recession. Then, it benefited from the …

Continue reading “Are loan books next on the block for Australia?”

FIRB Reforms Article Series – Part 1: National Security Businesses

The potential impact of the Commonwealth’s proposed reforms to Australia’s foreign investment regime With the release of a Discussion Paper on 5 June, the Commonwealth Government announced its intention to introduce sweeping reforms to Australia’s foreign investment review laws. As summarised in our recent article (which can be found here) the Commonwealth Government is intending …

Continue reading “FIRB Reforms Article Series – Part 1: National Security Businesses”

Schrems II – A view from downunder

Introduction – The challenge of extra-territoriality for non-EU businesses and GDPR Since the introduction of the General Data Protection Regulation (GDPR) in 2018, Australian businesses, like other non-EU domiciled businesses around the world, have grappled with the extra-territorial operation of the GDPR, particularly in the absence of a body of clear judicial interpretation on the …

Key changes to the Queensland Resources Sector – MEROLA heightens requirements for resource authority holders

On 20 May 2020, the Mineral and Energy Resources and Other Legislation Amendment Act 2020 (Qld) (the MEROLA) passed in Queensland Parliament. The changes introduced by the MEROLA have staggered start dates, with the first provisions already in effect from 1 July 2020. This article explores some of the most significant changes included in the …

Proposed DGR category for community sheds

Legislation recently introduced in the Federal Parliament will establish a new deductible gift recipient general category for men’s and women’s sheds. Schedule 3 of the Treasury Laws Amendment (2020 Measures No 2) Bill 2020 amends the Income Tax Assessment Act 1997 (Cth) and introduces a new deductible gift recipient (DGR) category applicable to public institutions …

Continue reading “Proposed DGR category for community sheds”