Are loan books next on the block for Australia?

Australia, like everyone else, has experienced a seismic shock to its financial system and economy arising out of the Black Swan of COVID-19.

And this time it is different, for an Australia which did not suffer in the same way as many other advanced economies arising out of the Great Recession. Then, it benefited from the resources super-cycle which cauterised much of the losses which Australia’s financial institutions might otherwise have experienced. It is true that many Australian financial institutions still suffered, had to repair their balance sheets by forced merger or divestment of some impaired loan books (like Suncorp or Bankwest), or had to exit the market winding down their loan books for reasons to do with their parent’s circumstances back in their home jurisdictions (like RBS and HBOS). But overall most survived relatively unscathed and have continued to fill out their loan books with commercial, mortgage and consumer debt.

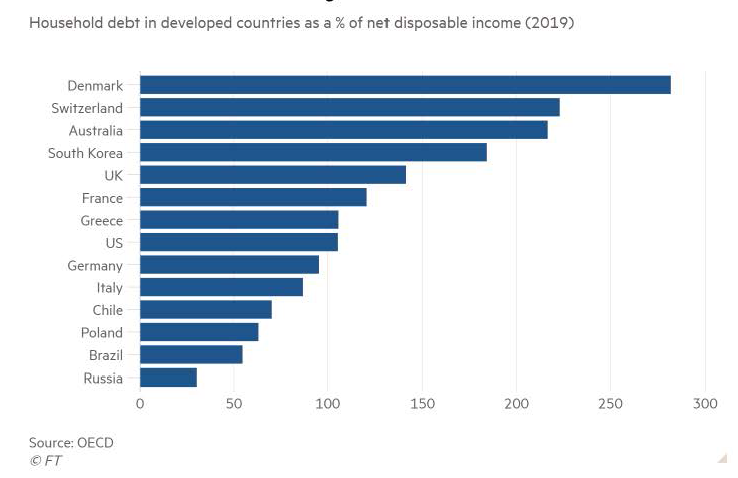

This had led, in short, to Australia having the third highest household debt levels in the OECD at a time when the country is experiencing its first recession in 30 years and worst in a century.

Australian households are among the most indebted

This always has consequences.

The Reserve Bank of Australia’s latest data paints a sobering picture.

And consequences generate opportunities.

It is stating the obvious to say that the future shape of any recovery is uncertain, as it is trying to call the bottom. Australia is still amidst a moratorium on debt enforcement and liability for insolvent trading as well as having undertaken a jobs furlough scheme through to 2021. It is only when these moratoria are lifted (currently at the end of September but this may be extended) and various emergency support schemes are unwound that we will see the true extent of the longer lasting damage to the economy, and find out what this means for business and consumer ability to meet accrued debt obligations.

In the immediate aftermath of 2008, our lawyers experienced a rise in loan book activity regardless of whether they were based in Australia, the UK or Ireland at the time. Whilst this time is different, there is sure to be some similar fall out based on the data already coming to light. We also anticipate further choppy waters ahead going into Q4 2020 once the emergency COVID-19 response measures are removed.

The Australian Government’s fear for the housing market illustrates this here.

We understand that banks, financial institutions, governments, private equity funds, special situations funds, asset managers, REITS and other specialist investors will have an interest in how commercial and residential loan books will be handled and we understand that process.

Consideration will need to be given to the most appropriate vehicle to be used to acquire the assets – commonly this will require consideration of whether a trust or special purpose company will be used. Whilst not necessarily a structure familiar to overseas investors, a trust in Australia may be the most appropriate vehicle to acquire the assets, particularly if the assets will be securitised. Trusts can allow ‘flow through’ tax treatment and, as a result, access to a lower rate of tax on distributions to foreign investors.

Each of the Australian States also levy transfer (or stamp) duty, which is often relevant to the acquisition of assets – particularly if the debtors are resident in Queensland. However there are specific exemptions available (for example, in relation to securitisation arrangements).

Consideration will also need to be given to how to assess, and ultimately best realise, the value of the assets. These processes require assembling and working collaboratively with advisers across a range of disciplines.

We already have the systems and processes in place to undertake vendor or investor due diligence, and to complete divestments, investments, acquisitions and workouts of loan book portfolios relating to real estate assets (property developer, commercial, office, retail and residential), leisure assets (recreational and hotels) and business (including professional services debt capital) and consumer debt.

Our team members have worked with many in this space including Macquarie Bank, Axa Real Assets, GMAC, Morgan Stanley, Goldman Sachs and QRIDA, and are happy to field any query.

This publication covers legal and technical issues in a general way. It is not designed to express opinions on specific cases. It is intended for information purposes only and should not be regarded as legal advice. Further advice should be obtained before taking action on any issue dealt with in this publication.